ADA Price Prediction: Technical Setup and Market Sentiment Point Toward $1 Breakout

#ADA

- ADA trading above 20-day moving average indicates bullish technical momentum

- Whale accumulation of 20 million ADA demonstrates institutional confidence

- Analyst projections of $1.15-$1.25 suggest significant upside potential from current levels

ADA Price Prediction

Technical Analysis: ADA Shows Bullish Momentum Above Key Moving Average

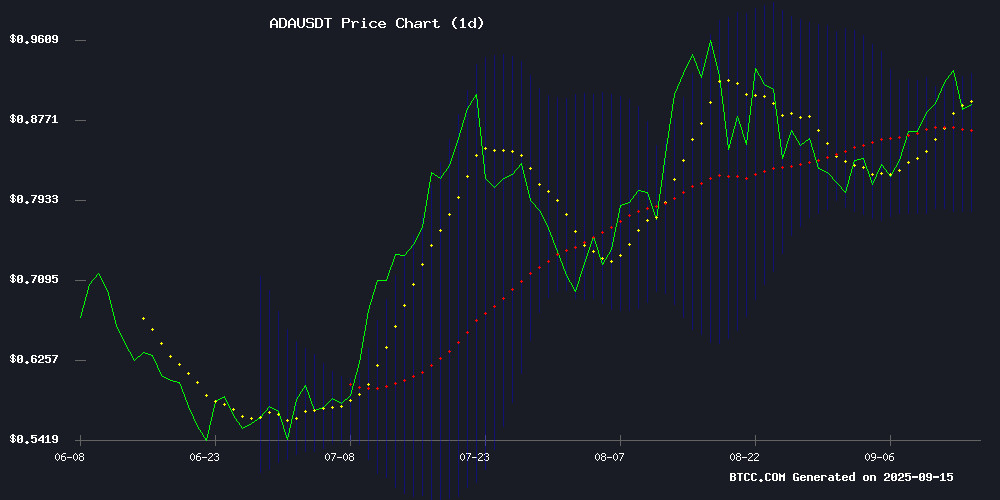

According to BTCC financial analyst Ava, ADA is currently trading at $0.8923, comfortably above its 20-day moving average of $0.8536. This positioning above the MA indicates underlying strength. The MACD reading of -0.019614 suggests some near-term bearish momentum, but the Bollinger Bands configuration shows price action remaining within normal volatility ranges with support at $0.781 and resistance at $0.926. The current technical setup suggests consolidation with potential for upward movement if buying pressure continues.

Market Sentiment: Whale Accumulation and Analyst Optimism Support ADA Bull Case

BTCC financial analyst Ava notes that recent market developments paint an optimistic picture for ADA. The accumulation of 20 million ADA by large investors, combined with prominent analysts projecting targets of $1.15-$1.25, creates positive sentiment momentum. While some investors are diversifying into emerging alternatives, the whale activity and analyst confidence align with the technical outlook suggesting potential price appreciation toward the $1 level in the NEAR term.

Factors Influencing ADA's Price

Cardano Eyes $1.15 as Top Analyst Sees Run Toward $1.25

Cardano (ADA) is gaining attention as crypto technician Ali Martinez outlines a bullish trajectory. The digital asset, currently trading near $0.90, faces key resistance levels at $1.15 and $1.25. A weekly close above $1.15 could signal further upside, with longer-term targets extending toward $1.78.

Martinez's analysis highlights ADA's recent breakout from near-term hurdles, with $1.15 acting as a critical pivot. Chartists note Fibonacci extensions and measured-move targets clustering between $1.15 and $1.78, contingent on broader market momentum and on-chain demand.

Cardano Whales Accumulate 20M ADA Amid Bullish Technical Setup

Cardano's native token ADA is drawing significant whale activity, with addresses holding 1-10 million coins adding over 20 million tokens in 24 hours. This accumulation coincides with tightening exchange liquidity, historically a precursor to upward price movements.

The cryptocurrency currently tests the $0.93 resistance level, a critical Fibonacci retracement zone. Technical indicators including the Parabolic SAR suggest bullish momentum, with potential upside targets at $1.019 and $1.166 upon successful breakout.

Market structure mirrors previous accumulation patterns where whale activity preceded substantial rallies. The renewed interest from large holders signals growing confidence in ADA's short-term potential after months of subdued price action.

Cardano Investors Pivot to Emerging PayFi Altcoin Amid ADA Market Pressure

ADA holders are shifting portfolios toward Remittix, a low-cap PayFi token touted for 20x potential, as Cardano faces renewed bearish pressure. The gravestone doji pattern signals whale sell-offs, driving ADA from $0.90 to $0.88 amid shrinking trading bands.

Market analysts note the migration reflects a broader search for high-utility alternatives during Cardano's consolidation phase. Short candle formations confirm the restructuring trend, with liquidity flowing toward niche sectors like cross-border payment solutions.

Is ADA a good investment?

Based on current technical indicators and market sentiment, ADA presents a compelling investment opportunity according to BTCC financial analyst Ava. The cryptocurrency is trading above its 20-day moving average, indicating underlying strength, while whale accumulation of 20 million ADA signals confidence from large investors.

| Metric | Value | Interpretation |

|---|---|---|

| Current Price | $0.8923 | Trading above 20-day MA |

| 20-day MA | $0.8536 | Support level |

| Bollinger Upper | $0.9261 | Near-term resistance |

| Analyst Targets | $1.15-$1.25 | 27-40% upside potential |

The combination of technical strength, institutional accumulation, and positive analyst projections suggests ADA could be positioned for movement toward the $1 level, making it an attractive consideration for investors with appropriate risk tolerance.